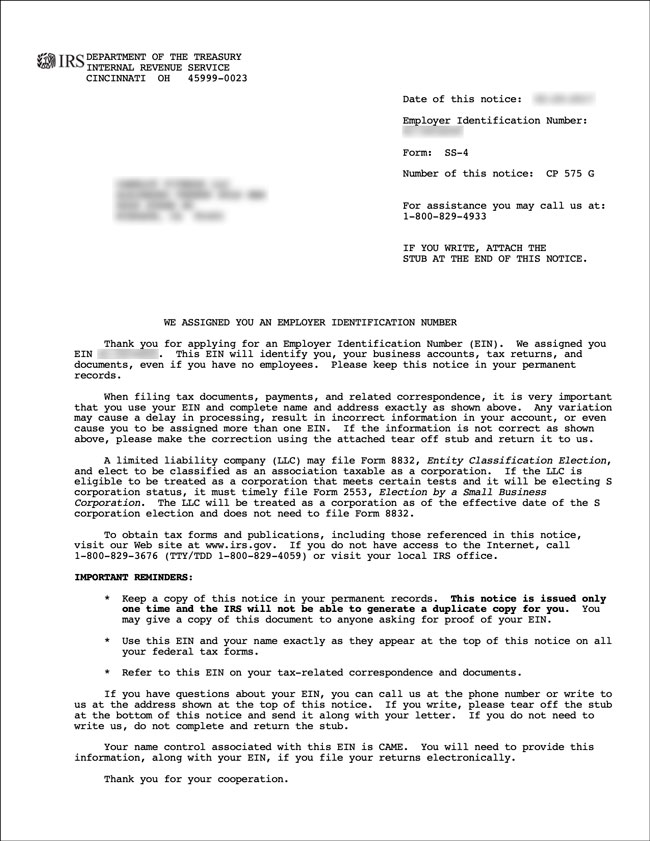

What Is the EIN Confirmation Letter?

When a business obtains an EIN number the IRS issues an official letter confirming the EIN. If you submitted your EIN application online the letter is directly available after the EIN is issued in PDF form. If you apply via mail, fax, or have the application completed by a third-party designee your letter is mailed to the address listed on the application.

Many entrepreneurs are unaware of the confirmation letter’s importance until a vendor or financial institution asks for it. The document plays an essential role in the life of your business. It accompanies other documents, such as the operating agreement, articles of incorporation, and by-laws.

What Is the EIN Confirmation Letter Used For?

An EIN confirmation letter is helpful when applying for loans and opening business bank accounts. You will also find the document useful for payroll processing and applying for a business credit card. Financial institutions rely on the document to verify your company’s employer identification number, name, and physical address.

Online payment systems like Payoneer and PayPal also use the document to verify company details for new business accounts. Small businesses applying for Covid-19 through SBA emergency loan programs need to submit their EIN confirmation letter. The CP-575 letter is a mandatory due diligence document used by lenders to approve economic injury disaster loans (EIDL) and paycheck protection programs (PPP).

Although many vendors and financial institutions only ask for the tax ID number, some verify the document’s authenticity. In such cases, they expect you to submit your CP 575 letter.

How Long Does It Take To Receive the Confirmation Letter?

Online

When you apply for the employer identification number via the IRS website, you receive the confirmation letter immediately. Thus, you can save a digital copy and print the document without any delay. The online application process is the easiest and faster option that involves interview-style processing.

You provide:

- A business address

- Your company’s registered name

- Business structure type

- Reasons for obtaining an EIN

- Primary business activity

IRS requires you to complete the application in a single session. For this reason, gather all the required information before starting the application process. The service is accessible via the IRS website during weekdays.

By Mail

If you opt to apply for the CP-575 letter via mail, expect to receive the document between four and eight weeks. On the other hand, if you apply via fax using Form SS-4, your confirmation letter will be available after appropriately four weeks.

What To Do if You Lose or Misplace Your Confirmation Letter

Many entrepreneurs lose or misplace the confirmation letter, necessitating reaching out to the Internal Revenue Service for a replacement. Although the tax authority only issues Form CP 575 once, it offers a replacement in the form of a verification letter or 147C letter.

Losing the letter is problematic because you need to confirm your company’s tax identification number to vendors and financial institutions. By obtaining the verification letter or 147C letter, you substitute the original Form CP 575.

How to Get a Copy of EIN Confirmation

The Internal Revenue Service provides a solution in the event that you lose or misplace your EIN confirmation letter. You can achieve this objective by calling the IRS and requesting the verification letter or the 147C letter. IRS issues the document free of charge via fax or mail. If your contact details have changed since you obtained Form CP 575, you can update the information on Form 8822.

When contacting the IRS for the verification letter, use the business and specialty tax line. The line is available weekdays between 7 a.m. and 7 p.m. on (800) 829-4933. Alternatively, contact the Internal Revenue Service directly and request the 147C letter. The tax authority provides dedicated numbers for US-based and international callers.

A company official whose name appears on IRS records should request the verification letter. Tax officials verify the identity of the caller before issuing the letter. Security questions fielded may include:

- The employer identification number.

- Company name and address.

- Tax forms filed by the business.

- The caller’s position in the company.

- The IRS does not issue the 147C letter via its website for security reasons.

Once the IRS employee confirms your identity, they process the request and issue the verification letter immediately. In some cases, banks and accountants can provide you with a copy of the tax ID certificate. This option is viable if you need the copy urgently.

Another potential solution is to check your company’s paperwork for a previously filed tax return. Doing so may help you find the confirmation letter, which the IRS notates with the employer identification number. On the other hand, your email inbox or archive is an ideal place to look for the document if you applied for the EIN online. Hence, the need to keep a digital copy of the document to avoid problems in the future.

It is also possible that you will find a copy of the confirmation letter in your PC’s download file. Also, thoroughly check your files before reaching out to IRS for requesting a replacement. Once you resolve this issue, you are ready to focus on growing your business.